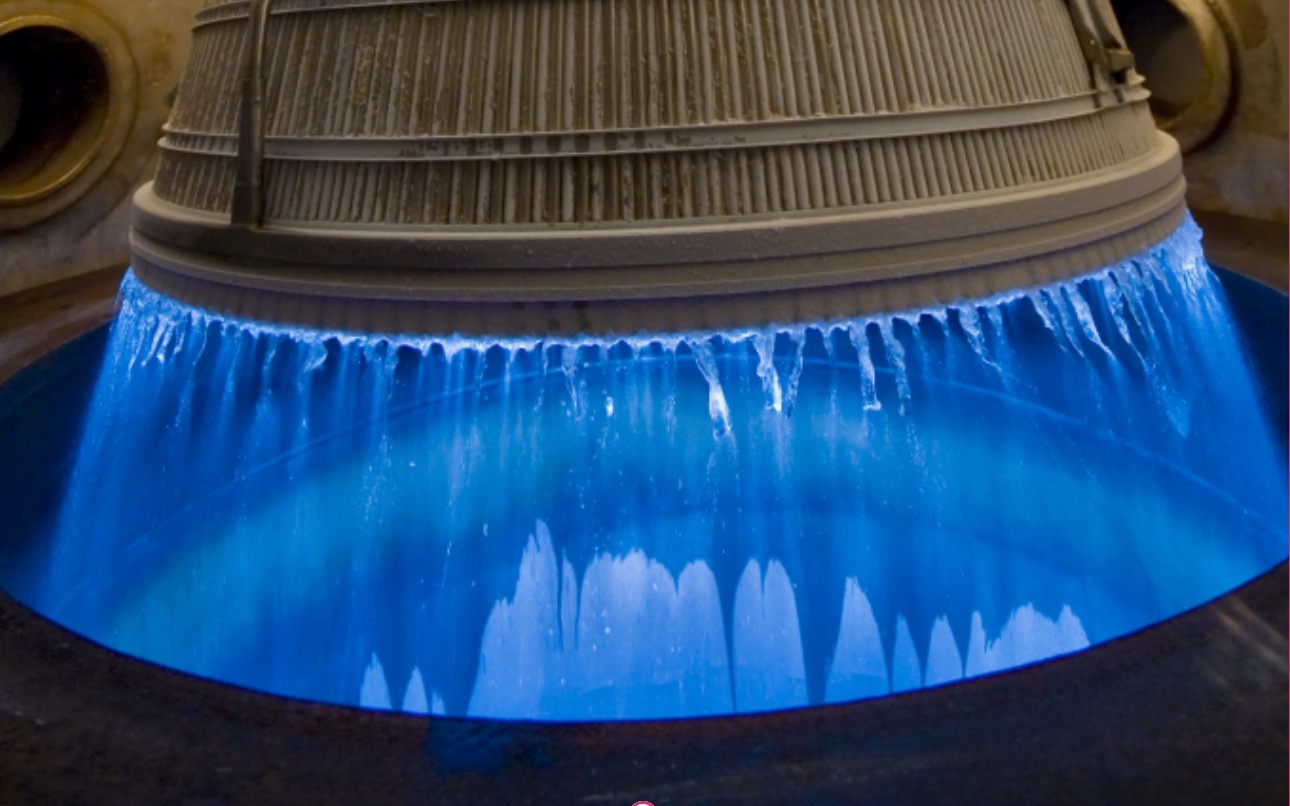

Credit: L3 Harris

L3Harris Technologies is spinning off the majority of its space propulsion business less than two years after absorbing Aerojet Rocketdyne.

The defense contractor announced today that AE Industrial Partners will acquire a 60% stake in its Space Propulsion and Power Systems division for $845 million. L3Harris retains the remaining 40% and expects to finalize the deal in late 2026, following regulatory approval.

L3Harris is headquartered in Melbourne and currently employs between 47,000 and 50,000 people globally.

What AE Industrial Partners Is Getting

The divested unit manufactures the RL10 upper-stage engine—currently flying on United Launch Alliance’s Vulcan rocket—along with electric propulsion thrusters and spacecraft power systems. Its hardware supports missions ranging from Mars rovers to NASA’s planned lunar Gateway station. The division also pursues advanced concepts in nuclear surface power and in-space nuclear propulsion.

AEIP is expected to revive the Rocketdyne name, one of the oldest in spaceflight. It was coined in 1955 when North American Aviation created a propulsion division.

“Rocketdyne is the birthplace of American rocket propulsion,” said Kirk Konert, managing partner at AE Industrial. He described the deal as creating a hybrid structure that combines defense-prime resources with the agility of a focused investor, with plans to modernize RL10 production while honoring the engine’s heritage.

The acquisition expands AE Industrial’s growing space portfolio, which already includes Firefly Aerospace, Redwire Space, and York Space Systems. Both parties indicated they will prioritize development of next-generation propulsion systems, particularly nuclear technologies considered essential for deep-space and cislunar operations.

What L3Harris Is Keeping

L3Harris is keeping the RS-25 program entirely in-house. The legacy engine, which powers NASA’s Space Launch System for Artemis lunar missions, carries long-term government contracts that the company will continue to fulfill as prime contractor.

Company leadership framed the partial sale as a strategic pivot toward missile production and other defense priorities. CEO Christopher Kubasik said the transaction “further sharpens our portfolio around core mission priorities” while supporting faster, more responsive defense manufacturing.

Leave a Reply